I'm not taking a political or moral stance, these are just the numbers.

A couple million dollars in the big cities like LA, NYC, Seattle, Toronto, San Fransisco, ect. isn't what it used to be. It certainly is something if you're young and you've got your whole life to earn more money and you're reinvesting that money. But you wouldn't be comfortable retiring in those cities at 40 with $2 million

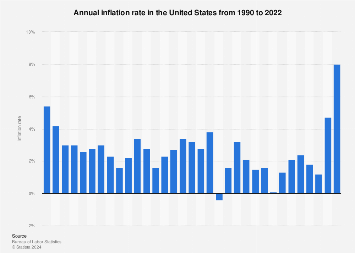

for the rest of your life. Especially with inflation, rising taxes, rising cost of living (which is distinct from inflation), ect. If you make decamillionaire status you should be able to thrive whatever the conditions are. The mindset in the 1920's was, "I want to be a millionaire," not, "I need to be a millionaire to retire middle class." Most people had not factored in the last 70-90 years of inflation.

The history of millionaire: in the 1750's Thomas Jefferson was the first one to popularize the word. But it didn't come into its full popularity until the 1920's.

A million dollars in 1920 was worth about ~$15 million today. So thats what a millionaire originally meant. The term millionaire was already so old, a millionaire in 1990 meant $2.3 million back then. It was a good amount of money,

it was more than it is now. So even in that day and age the word lost a lot of its meaning.

A high-net-worth individual (HNWI) is someone who has liquid assets (excluding their primary residence) over $1 million. Above that a very-high-net-worth individual (VHNWI), with a net worth of at least US$5 million. Next is an ultra-high-net-worth individual (UHNWI) who has $30 million in investible assets. Individuals with a net worth of over $1 billion are considered to occupy a special bracket of the UHNW.

HNWIs constitute only 0.003% of the world's population and hold 13% of the world's total wealth. In 2017, there were 226,450 individuals designated as UHNWI with their combined total wealth increasing to $27 trillion.

So today by the time you retire (in America) you should have a couple million dollars including the cash that you have, equities (IRA & 401K), your home which is usually payed off at that point and that things of that nature. You pretty much need a couple million dollars in places like Toronto or Seattle to be comfortable. And it can't all be in your home. If you want to be able to have a lifestyle of $60,000 a year which isn't that comfortable in Toronto or Seattle. Most people in places like Toronto are married so you and your spouse are each getting social security (OAS), your pension and some investments or you're just spending through a million dollars over the course of two decades. But below that, especially if you don't own your own home, you can be in some trouble.

A "millionaire" these days is maybe an upper middle class retiree.

With a 3.1% inflation rate, a million dollars will loose 61% of its value after 30 years.

Keep in mind, this can be very geographically and currency dependent due to cost of living. Manilla is very different from LA. Many retired people geo-arbitrage their income. This can also depend on your lifestyle.

As a side note, you can see from the graph below, technically is inherently *deflationary*

In economics, the inflation rate is a measure of the change in price of a basket of goods.

www.statista.com

This century has seen divergent price movement. Many consumer goods are cheaper, while critical categories like health and education have skyrocketed.

www.visualcapitalist.com

An annual income anywhere between $360,000-$950,000 can grant entry into the top 1%—depending on where you live in America.

www.visualcapitalist.com

Major financial centers—London, Singapore, and Hong Kong—feature in these rankings of cities with the most millionaires.

www.visualcapitalist.com

www.moroccoworldnews.com