I would agree that only death is certain in life and in death all humans (whether rich or poor) and every living being and even every "non-living beings" like stars and the universe are united in dying sooner or later.

Taxes are very much manageable - not as a wage-slave but as self employed person / company. "Trouble" in life is a very much a subjective feeling and experience.

That's right and wrong in the same time. If taxes were used in a way to benefit the ones in need and all that they'd be good but actually all taxes collected are not enough to "finance" the "luxury" we all and even poor people experience in comparison to ancient times - and taxing the ultra rich with 90% will also lead to nowhere! All countries are in debt to one another and to so called central banks who issue money just by pressing a button - literally. This will inevitably lead into an economic discussion and I want to avoid it bc it will lead to nowhere here and is complex stuff that can't be answered easily.

Thats not exactly how money creation works.

The Austrian Neo-Keynesian Monetarists all agree that if you create money you're gonna get inflation. Thats not empirically true. In 2008 the Federal Reserve balance sheet was $800 billion dollars. In 2015 it was $4.5 trillion. Today its about $7.5 trillion. There's no inflation, so inflation doesn't correlate to money supply. the key to inflation is velocity its the turnover rate. And right now they're creating money like crazy and giving it to the banks to buy Treasury notes thats how they increase the money supply. The stick the Treasury notes on the Fed balance sheet and they just sit there. The banks have the money but they give it back to the Fed in the form of excess reserves. And they get a little bit of interest on it. But the money doesn't go anywhere. Its the lending, spending basically the increase in turnover of money that could give you inflation.

We use Modern Monetary Theory today (MMT)

What determines the strength of a country's currency is: Supply and demand, the interest rates of each country, the trade balance of each country, and the perceived stability of the currency and the governments, plus economic factors like higher oil prices, which helps the Canadian dollar for example. Fx = f(economic and political health of country and BOP) Balance of Payments.

Credit cycle and the lending cycle is critical to creating vital economies and banks / Fed are at the center of the process .. without borrowing : lending you would not make some of investments needed for growth

Go back to

cecchetti or krugman texts. Debt is not bad, just remember what it finances - houses, plant&equipment and new ventures

And money measure -- the Ms -- are just convenient accounting measures

Hint: not the Rothschilds and bankers

In my opinion it's not about reducing wealth inequality through taxes specifically, it's about using the surplus of money from actually taxing the wealthy to enrich our schools and infrastructure which just gives people a better shot at life in general.

Taxes pay for roads, bridges, hospitals, interstate highways, ect. Again, not managed correctly but its still not directly robbery. Central banks do not own countries and it does not work like a family owing a credit card company money.

Government programs like social security buy government bonds. There's no social security trust. It's been ruled in income tax by the supreme court. They take your money and buy a T-bill so it's really just giving money back to the government. It's not a savings account. It's a transfer system. This is where most of the debt is from.

Over the past 50-100 years we've had a massive increase in the global population. We've had massive productively gains with technology and overall the world has been pretty prosperous. A big part of that comes from demographics where you have a population pyramid of more young people supporting not that many old people. You have a huge workforce that is paying payroll taxes (at least in the US) and paying Medicare taxes, ect. And that helps support old people and finance the system. Now birthrates are collapsing globally especially in east Asia and the US. America's population pyramid is all from immigration (we'll see how long that lasts…). But overall we've had an inversion of population pyramids. At least in democracies, the old cohort is going to be a massive voting block and they will continue to vote themselves as many benefits as possible as the younger generations continue to shrink as they don't have as much say in politics. Maybe this will lead to some kind of fascism, I don't know. The whole current financial system is based on population growth, productivity gains and the transfer payments from working individuals to retired individuals. So in 100 years when the population begins to collapse and the taxes are much higher - global stock markets, government debt and taxes to support an aging population globally (this will even come for Africa, too, at some point. They probably have it worse because they have huge birthrates now that will probably reverse), whats going to happen? I imagine its going to be worse - taxes and government debt will be high and the stock market (depending on what is representative of the stock market) may not do as well because you have fewer people working in corporations. The only thing that I think would save us would be some type of new technological revolution which maybe enhances lifestyles or lifespans and makes massive gains in productivity for a shrinking working population. Which is entirely possible. If we don't have massive increases in productivity or reverse this crisis, government finances may be so strained that retirement benefits are cut and maybe the global economy starts to flatten out or decline.

This is a whole area of research and analysis for the USA and many other countries that I do not know very well. YES, demographics and intergenerational transfers in many different countries with many complex financial and tax issues. This is an area you could research at school as you pursue another degree

https://www.nber.org/programs-proje...-disability-research-center?page=1&perPage=50

Also in the mid 20th century, the top 1% payed an income tax of 90% at one point

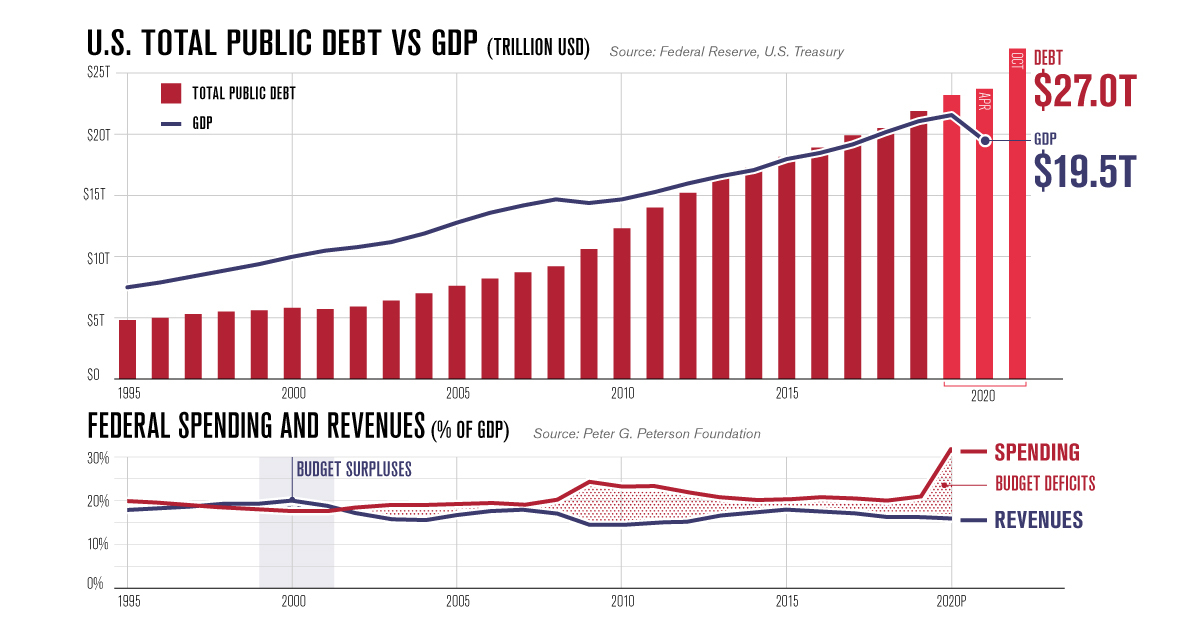

America's debt recently surpassed $27 trillion. In this infographic, we peel back the layers to understand why it keeps on growing.

www.visualcapitalist.com

The debt isn't an issue as long as they can make interest payments. BOP

Thats not exactly how money creation works.

The Austrian Neo-Keynesian Monetarists all agree that if you create money you're gonna get inflation. Thats not empirically true. In 2008 the Federal Reserve balance sheet was $800 billion dollars. In 2015 it was $4.5 trillion. Today its about $7.5 trillion. There's no inflation, so inflation doesn't correlate to money supply. the key to inflation is velocity its the turnover rate. And right now they're creating money like crazy and giving it to the banks to buy Treasury notes thats how they increase the money supply. The stick the Treasury notes on the Fed balance sheet and they just sit there. The banks have the money but they give it back to the Fed in the form of excess reserves. And they get a little bit of interest on it. But the money doesn't go anywhere. Its the lending, spending basically the increase in turnover of money that could give you inflation.

What determines the strength of a country's currency is: Supply and demand, the interest rates of each country, the trade balance of each country, and the perceived stability of the currency and the governments, plus economic factors like higher oil prices, which helps the Canadian dollar for example. Fx = f(economic and political health of country and BOP) Balance of Payments.

Credit cycle and the lending cycle is critical to creating vital economies and banks / Fed are at the center of the process .. without borrowing : lending you would not make some of investments needed for growth

Go back to cecchetti or krugman texts. Debt is not bad, just remember what it finances - houses, plant&equipment and new ventures

And money measure -- the Ms -- are just convenient accounting measures

Hint: not the Rothschilds and bankers

In my opinion it's not about reducing wealth inequality through taxes specifically, it's about using the surplus of money from actually taxing the wealthy to enrich our schools and infrastructure which just gives people a better shot at life in general.

Taxes pay for roads, bridges, hospitals, interstate highways, ect. Again, not managed correctly but its still not directly robbery.

I would agree that only death is certain in life and in death all humans (whether rich or poor) and every living being and even every "non-living beings" like stars and the universe are united in dying sooner or later.

Taxes are very much manageable - not as a wage-slave but as self employed person / company. "Trouble" in life is a very much a subjective feeling and experience.

That's right and wrong in the same time. If taxes were used in a way to benefit the ones in need and all that they'd be good but actually all taxes collected are not enough to "finance" the "luxury" we all and even poor people experience in comparison to ancient times - and taxing the ultra rich with 90% will also lead to nowhere! All countries are in debt to one another and to so called central banks who issue money just by pressing a button - literally. This will inevitably lead into an economic discussion and I want to avoid it bc it will lead to nowhere here and is complex stuff that can't be answered easily.

Whats your finance background, if I may ask?